With the 2008 credit crisis now just a memory for many of America’s richest, a remote island chain in the celeb-beloved Bahamas is experiencing a real estate boom.

A rising tide may be said to lift all ships, but when it comes to financial crises, the effects are often less than equally distributed. After months of poor economic data, record jobless claims, and devastating housing sales numbers, the clear winners that have emerged throughout the downturn have been America’s super-elite. According to a recent article in the Wall Street Journal, sales of luxury homes have been thriving, both within and outside the USA. In particular, the isolated Exuma islands of the Bahamas have risen in popularity for wealthy investors. The 360+ islands composing this chain may be just 40 miles from bustling Nassau, but they are a world apart from the capital’s massive hotels and glitzy casinos.

A Secret Celebrity Paradise

The incomparable privacy offered by the Exumas has led the islands to become a haven for solitude-seeking CEO’s, and even a few notable celebrities. Great Exuma, the sleepy chain’s largest isle, was a favorite holiday spot of Jackie Onassis. Country musicians Faith Hill and Tim McGraw own an island here, as do Johnny Depp, Eddie Murphy and illusionist David Copperfield. Nicholas Cage reportedly sold his undeveloped Leaf Cay recently, although it has since returned to the market. For those seeking a private island to rent, rather than own, the chain offers a singular property: Musha.

Copperfield’s 150+ acre Musha Cay operates as one of the world’s most luxurious island rentals, a lavish paradise of beach villas and sugar-sand beaches. The island has won dozens of travel awards, such as those from World Travel, Conde Nast, and Quintessentially, and entertained guests like Oprah Winfrey and John Travolta. With so many accolades, it’s no wonder that rates for a party of 12 start at $37,500 per day (four night minimum.) Other celebs spotted enjoying island-hopping holidays elsewhere in the Exumas include Bill Gates, Maddona, and Tom Cruise, claims the official Exumas tourism website.

After the Bust, a New Real Estate Boom

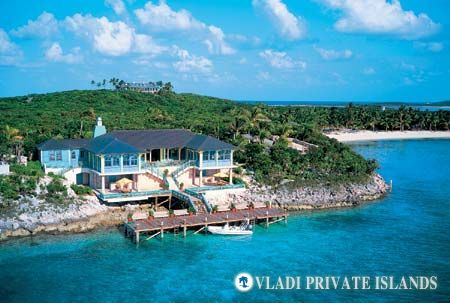

The WSJ article puts forth an image of a real estate market truly on the rebound, with major tourism developments and significant interest from island buyers – one Bahamas broker was even quoted as saying that he is seeing serious buyer interest for properties in the $30-$50 million range. On the website of Vladi Private Islands, the preeminent international island brokerage, there is a myriad of high-end properties in the Exumas. Located close to Musha Cay, Cave Cay is a fully-developed 222-acre isle complete with an airstrip, luxurious main residence and a full harbour and marina. The island has approvals for an extensive commercial development, including a hotel, clubhouse and variety of amenities.

Far from the typical image of a small sandy isle with just enough space for a few palm trees and a beach house, islands in the Exumas are often sprawling – the 180-acre Williams Cay is also listed for sale through VPI, as is Coakley Cay, an even vaster 340-acre island. The immense size of these properties means they won’t come cheap – both are priced well over US $20 million – but the new wave of tourism development in the area suggests that if government permissions allow, islands like these could be used for commercial, rather than just personal, uses.

Exciting Times for the Out Islands

The Bock Cays archipelago, comprised of eight islands including the 365-acre Bock Cay and the 266-acre Prime Cay, are reportedly being developed into a large holiday complex with hotels, villas, and a golf course. Rumoured to ultimately cost more than US $75 million to develop, the expansive Bock Cays resort will no doubt usher in a new crop of paradise-seeking visitors to this little-known chain. As with most other luxury travel destinations, a lack of available global credit and liquidity during the last three years spelled slower times for the Exumas, but those days appear to be over. With so much action on the market, at least for the Bahamas, the worst of the real estate downturn seems to have passed – a positive sign that for some investors, it’s time to dip their toes back into the water.

Read the original Wall Street Journal article here: Link