The Seychelles has agreed to an innovative debt-swap agreement which will see the island republic’s debt reduced in exchange for a greater commitment to marine conservation.

The Government of the Seychelles has agreed to a transformational “debt-for-adaptation” swap which – if successful – will see the country’s main bilateral creditors buy back debt in exchange for a greater commitment to marine conservation and the creation of a long-term, sustainable development plan.

Under the proposed agreement, almost USD 80 million of the country’s public debt would be either pardoned or bought back by official sector creditors in exchange for the establishment of a permanent trust fund endowment (the Seychelles’ Conservation and Climate Adaptation Trust) which will provide predictable levels of dedicated funding over a long term timeframe.

With the help of The Nature Conservancy, the Seychelles Government is working to raise the necessary USD 7 million grant funds needed to get the innovative project off the ground. Oceans 5, an international funders collaborative dedicated to the protection of the world’s oceans, has already stepped forward with an initial investment of USD 500,000 but much remains to be done before the debt swap can take place.

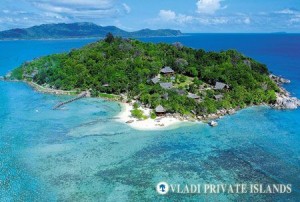

As well as the aforementioned trust fund endowment, the debt swap agreement will – if successful – also result in the creation of the Indian Ocean’s second largest Marine Protected Area (approximately 400,000 km² of the country’s territorial waters), increasing protection for the country’s important tuna and tourism sectors, whilst serving as a model for other Small Islands Developing States and coastal communities.

Due to a toxic combination of limited natural resources, a dependence on imports and their isolated geographical location, many of the world’s Small Islands Developing States (SIDS) currently register unsustainable levels of debt. Indeed, a survey carried out by United Nations Development program revealed that in 2010, fourteen of the world’s SIDS – including the Seychelles – registered debt to GDP levels of over sixty per cent.

Frequently spending more than they earn, the SIDS are trapped in a seemingly endless spiral of debt. As existing debts increase, governments are forced to set aside more and more money to pay off the debt, forming a huge burden to investment and economic growth whilst also compromising their ability to channel resources the policies that matter the most: health, education and the environment.

Championed by President James Michel and the Environment, Finance and Foreign Affairs Ministries of the Seychelles, Debt Swap is a pioneering financing mechanism. Responding to the high debt burden experienced by the vast majority SIDS, debt swaps not only ease the fiscal pressure on these vulnerable countries, but also encourage economic growth by reducing financial barriers to the implementation of important climate adaptation strategies.

Have your say: Is the Seychelles debt-for-adaptation swap a good thing? Share your views on Facebook, Twitter or Google+